Let’s refresh Wealth management together!

Welcome to our refreshing approach to wealth management! Everything starts with a “Y”, the why that challenges the status quo and the attitude that drives you towards a purpose.

So why choose an independent wealth manager? Why work with us? And why are you on this website right now? Let’s find out together and discover the endless possibilities that come with a “Y” mindset.

Let’s refresh wealth management together!

Welcome to our refreshing approach to wealth management! Everything starts with a “Y”, the why that challenges the status quo and the attitude that drives you towards a purpose.

So why choose an independent wealth manager? Why work with us? And why are you on this website right now? Let’s find out together and discover the endless possibilities that come with a “Y” mindset.

combined experience

professionals

spoken

Our story

We, empowered female Managing Partners from different generations, united in our mission to refresh wealth management.

Together with our CIO, Mikaël and with a combined total of over 90 years of industry experience, we have seen it all.

From financial crises and market volatility to generational transfers, we have accompanied and support our clients at every step.

As a Swiss company with an international team, we pride ourselves on our core values and our commitment to accompanying families on their investment journey.

Let us use our expertise and experience to guide you towards financial success.

Because everything starts with a Y

Our values

Our Beliefs

- Your Family Office: While investments are at our core, family office is key; we are an exclusive group of families.

- Technology: We embrace innovative digital tools as a key enabler in our interactions.

- Compounding: As opposed to portfolio churning: this is how we outperform.

- Collaboration: With the best and brightest business partners rather than internalizing.

- Independence: We are paid only by our clients: we take no retrocession and we do not sell any funds or products to our wealth management clients.

Our 360 offer

- Family office: we are the conductor of the opera

- Resilient Portfolio Construction

- Preferred access to banking

- Access to private investments

- ESG and impact asset allocation

Our clients’ profile

AND INTERNATIONAL FAMILIES

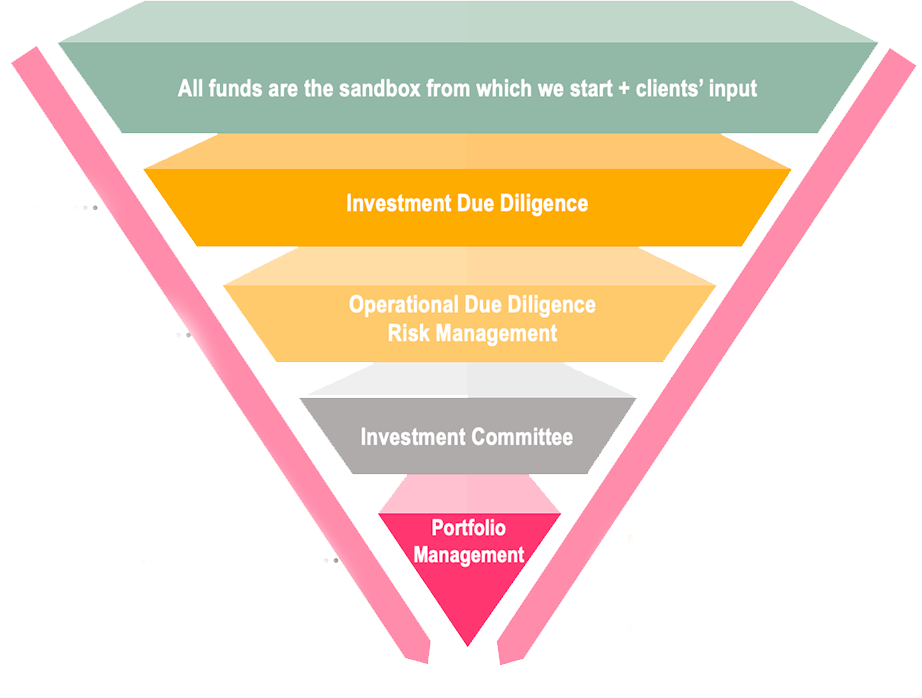

Our investment process and philosophy

What sets us apart from others is our unparalleled expertise in both liquid and illiquid asset classes,

including Fixed Income, natural resources, extensive experience in equity markets, and our strong

focus on Private markets.

Thorough selection of asset managers

We have a deep network thanks to our long-term relationships in the wealth management industry

Macro-economic analysis: the economy determines long-term financial markets and global macroeconomic picture helps assessing investment decisions.

Top-down asset allocation: We build our portfolios based on the economic environment and allocation between major asset classes. For bonds, we consider government – corporate, investment grade – high yield allocations; For equities, we take into account country and sector allocations, as well as thematic opportunities.

Risk management is a cornerstone of our process. Assessing the current risk implied by financial markets (economic, political risks) is key. At a portfolio level, depending on the market context and the client’s sensitivity, risk mitigation, strategies can be implemented.

Finally, the instrument selection process: we select and mix between cheaper passive vehicles (index funds and ETFs) and active managers to potentially add extra alpha (return) by outperforming markets. For bonds, we adopt a buy-and-hold strategy via single lines but funds as well for the thematic plays.

Your Team

- 47y

- 27y

- Swiss

- French, English, German, Spanish, Italian

Wealth

Management

- 25 years of experience in wealth management (Lombard Odier, and then CEO of the Swiss Branch of a large independent wealth manager)

- President of the Alliance of Independent Swiss Wealth Managers, she also sits on various boards like Swiss Athletics, Kofi Annan Foundation

- Nicole holds a BA in Political Science of Université de Lausanne and an MBA from ESADE (Spain)

Passionate about: African art & culture

- 40y

- 17y

- Swiss

- French, English, Arabic, Spanish

Portfolio Management

& UHNW Client Servicing

- Worked for an Independent Asset Manager in Geneva for 11 years as head of the Portfolio management team

- Prior to that, Yasmine worked at ACM a currency trading company for 4 years as responsible for operations

- Yasmine holds an MBA as well as 2 bachelor’s degrees in Finance & Marketing/communication from the Institute of Finance and Management in Geneva

Passionate about: Origami

- 37y

- 17y

- French, Swiss

- French, English, Spanish

Multi Asset

Class

- Former Head of Advisory at a Swiss Private Bank with a multi-asset focus, in charge of equity buy-side, fund selection, fixed income research and private markets

- Mikaël started his career at Lombard Odier and held various positions as equity analyst, sales trader, and product specialist across various firms

- He holds a Bachelor of Commerce from McGill University in Finance & Strategy and is a CIIA charterholder

Passionate about: Any sport that slides or glides

- 55y

- 30y

- Swiss

- English, German

Board

- Experienced Senior Consultant and Board Member, specialized in the tech, financial and insurance sector.

- Senior leader with broad experience in leadership development and transformation programs and in a wide range of finance topics (Art, Consulting, M&A).

- Kristian thrives in complex, international environments and his goal is to ensure a clear vision to achieve results.

Passionate about: White sneakers

- 52y

- 31y

- Swiss

- French, English, Levantine Arabic

Specialist

- Before founding her own firm specializing in fixed income in 2009, she was Deputy Head of the Fixed Income Division in Asset Management at HSBC Private Bank (Switzerland)

- Prior to HSBC Annie was a buy-side equity analyst (Consumers) at Banque Jacob Safra in Geneva & various private banks in Geneva

-

Annie holds a BS in Quantitative Analysis from the University of Geneva

Passionate about: Literature and classical music

- 23y

- 3y

- French

- French, English, Hebrew

Management

- Aryé holds a Bachelor's degree in Economics and Management, and a Master's degree in Wealth Management from the University of Geneva. He also has the SFI (Swiss Finance Institute) certification.

- He gained experience through various companies active in finance and wealth management.

- He has also acquired valuable interpersonal skills while working in luxury real estate and serving as a research assistant at the University of Geneva.

Passionate about: Vintage cars but rides an electric bike

- 28y

- 1y

- French

- French, English, German

Manager

- David holds a Bachelor’s and Master’s degree in Computer Science from the University of Geneva.

- He is passionate about applying his technical skills to bring a different perspective to portfolio management and has gained experience doing machine learning research at the University of Geneva.

Passionate about: Science and history

- 33y

- 10y

- Brazilian

- French, Portuguese, English, Spanish, Italian

Office Management and Compliance

- Aline holds a bachelor’s degree in Psychology from the University of Geneva and a diploma in business administration from !fage (Geneva).

- She began working in finance while still at university and gained experience through various companies active in finance.

- Aline has close to 10 years professional experience and specializes in family office related work as well as compliance and accounting.

Passionate about: Very sporty but passionate about Sunday afternoon naps.

Our partners

IT

solutions

Qualitative and Quantitative assessments

Swiss-based

custodian banks