Our Investment Philosophy

Macro-economic analysis: the economy determines long-term financial markets and global macroeconomic picture helps assessing investment decisions.

Top-down asset allocation: We build our portfolios based on the economic environment and allocation between major asset classes. For bonds, we consider government – corporate, investment grade – high yield allocations; For equities, we take into account country and sector allocations, as well as thematic opportunities.

Risk management is a cornerstone of our process. Assessing the current risk implied by financial markets (economic, political risks) is key. At a portfolio level, depending on the market context and the client’s sensitivity, risk mitigation, strategies can be implemented.

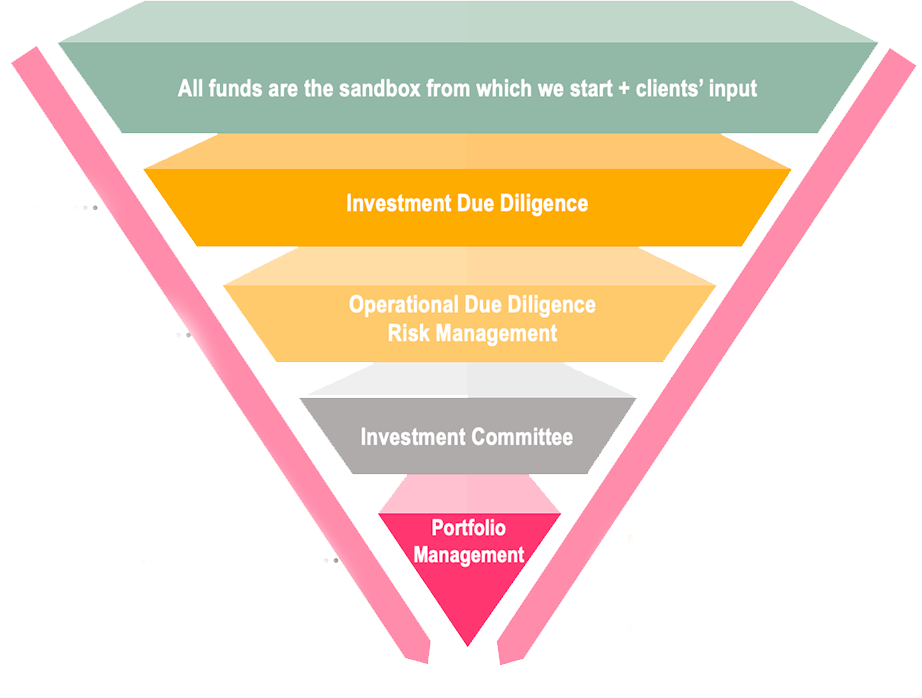

Finally, the instrument selection process: we select and mix between cheaper passive vehicles (index funds and ETFs) and active managers to potentially add extra alpha (return) by outperforming markets. For bonds, we adopt a buy-and-hold strategy via single lines but funds as well for the thematic plays.