Pension management

Your Swiss pension funds assets (libre-passage and 1e assets), aligned with your strategy

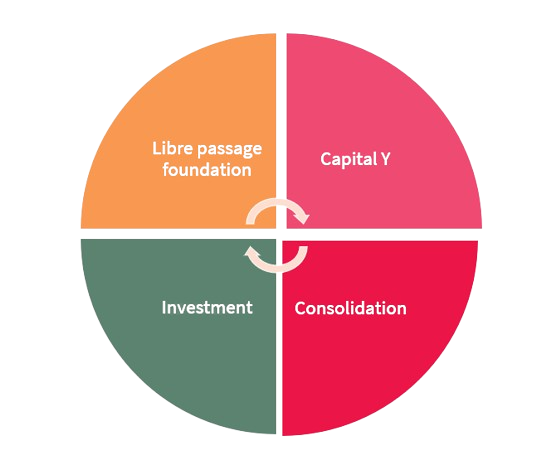

In Switzerland, career transitions, sabbaticals, or early retirement often result in the transfer of occupational pension assets into a “libre-passage”. Separately, many executives and high-income earners contribute to 1e pension plans, which cover the supramandatory (sur-obligatoire) portion of occupational pensions and offer greater flexibility in investment strategy.

These assets are too often treated separately – fragmented from your overall strategy, subject to generic solutions.

Our solution is:

- Strategically coherent: your pension capital is aligned with your long-term goals, not siloed;

- Operationally simple: consolidated reporting integrating other of your assets, managed by the same experienced team;

- Fully compliant: we operate under the OPP2 framework, regulated by FINMA and OSIF.

Our model is independent by design

We don’t sell financial products. We don’t operate sales networks. We don’t receive retrocessions.

Unlike many institutions that embed fees in complex structures, we keep costs transparent and your capital fully invested.

Whether you’re planning a career move, managing accumulated pension savings, or optimizing your 1e allocation, Capital Y offers a clear, tailored, and conflict-free solution—designed to serve your long-term financial well-being.

For professionals navigating transitions, entrepreneurs between ventures, or executives planning early retirement, Capital Y offers clarity, continuity, and control.

Because managing your pension assets should be as wYse as managing your future.